Option ARMs are a little different than regular ARMs. A borrower gets to pick their payment from three separate options, an amortizing payment (sometimes you could chose between a 15 year amortizing or a 30 year amort. loan), an interest only payment based on market interest rates, or a payment based on a lower interest rate (around 2%) with the difference between the lower interest rate and the market interest rate just added onto the balance. Then at year 5, or 10, the loan would recast as a regular amortizing loan, or if the negative amortization (resulting from the lowest payment option) caught up with the balance cap (typically around 120% of the value), it would recast sooner.

So, let's look at a simplistic example. It's 2007. Connie buys a house for $300,000 with an 100% LTV senior Option ARM with a 6% rate, and a 2% teaser rate. She makes $44k per year, has 4 kids, and no other bread winner in the house. It's doomed to fail from day one, but why not make the mortgage - someone else will get the business if we don't, right? The Option ARM is scheduled to recast at either year 5, or 120% LTV, which ever comes first.

30yr Amortizing Payment = $1,798.65 per month

IO Payment = $1,500

Neg AM Payment @ teaser rate = $500

"Hmmm, which one to go with, one that is 40+% of my gross income, or one that is 14% of my gross income", Connie thinks to herself. She decides to go with the $500 per month payment. So, she pays $500 per month on the outstanding balance, which itself goes up by $1,000 per month due to the negative amortization (her payment would have been $1,500 if she had chosen the IO payment at the market rate, so the difference is $1,000). At the end of year 5, her outstanding mortgage has grown to $360,000 due to negative amortization, and her amortizing payment due in month 61 is $2,132.39, a full four times higher than what she paid the first month, and 60% of her gross income.

But wait! There's more. This isn't even the worst of it. We assumed she made it the full five years for the recast to reset, and most of the option ARMs made in 2006 and 2007 are recasting early because they have already reached the reset level of 110% or 120% (it varied from deal to deal). We also assumed the rate reset at 6%, and in actuality it may reset lower. So, instead of the proverbial SHTF in 2012, it actually starts in the fourth quarter 2009, and just keeps picking up steam in 2010. See the chart below from Business Week - it shows the original recast schedule, and the actual recast schedule for outstanding option ARMs.

And a similar chart from a different source:

The subprime problem is over, the ARM resets in that universe had an average payment shock to the borrower of say, 20%, on the high side. That destroys a family living on the edge of their means. Fitch estimates the average payment shock on Option ARMs to be 63%, and 85% of Option ARM borrowers from 2006 and 2007 vintages chose the negative amortizing option!

Look at the payment shocks in yellow from the WSJ:

This is going to be bad people! I actually think the WSJ graphs aren't reflecting the earlier recasts, so it's even worse, people! "But we survived Subprime, and those were for poor people - we're middle class". Okay, we're talking about your dumb friends and neighbors, we're talking about more maturities and resets, substantially more than subprime (>40% of total ARMs done in 2006 and 2007 were Option ARMs), and we're talking AVERAGE payment shocks of 63%. On the other hand, the government will probably fix it all, so let's move back to focusing on CRE and opportunities in that market - it's not like a 63% payment shock to option ARM borrowers will hurt retail sales or anything like that, so long as we have home buyer credits, cash for clunkers, and government programs to re-write our mortgage contracts...

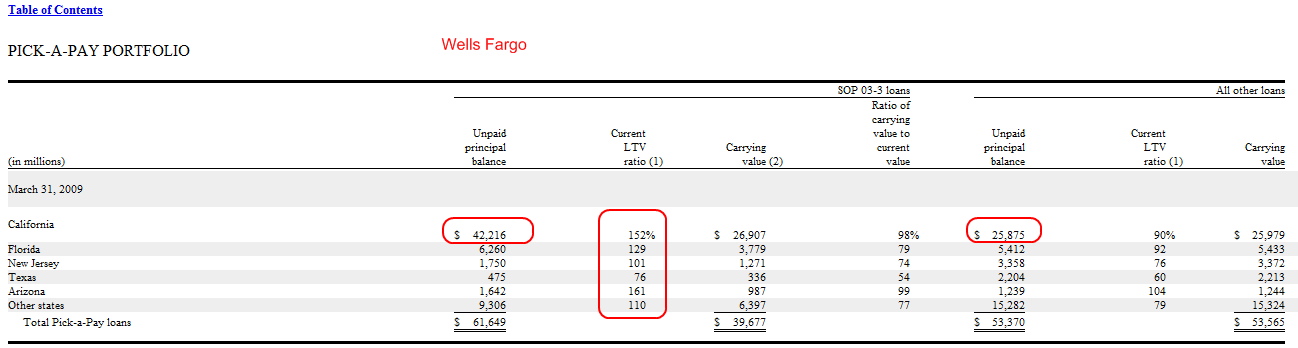

Further, I think I'd want to get out of any Wells positions - their "Pick-A-Pay" portfolio is on the left:

No comments:

Post a Comment