My favorite is their sophisticated model analysis

loans will be assumed to default during the term if the stressed cash flow would cause the loan to fall below 0.95 times (x) debt service coverage ratio (DSCR) or at maturity if the loan can not meet a refinance test of 1.25x DSCR based on a property specific refinance rate of 8% to 9% on a 30-year amortization schedule

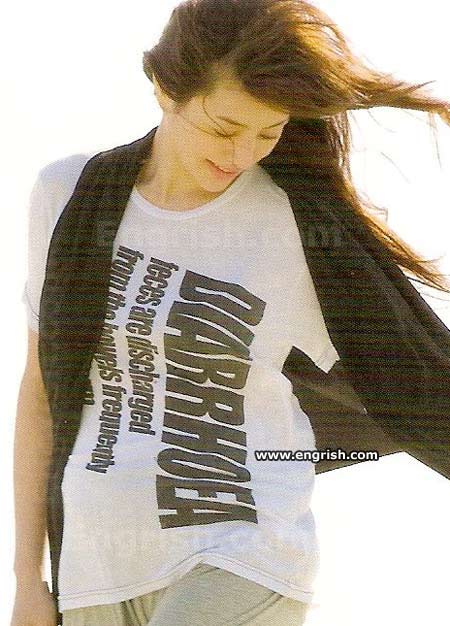

I love comments like that - makes you wonder what's on the inside of the model

No comments:

Post a Comment